Start Small, Dream Big Later

The dream of owning a home in Zambia is a powerful one. Visions of a beautiful, custom-built house often dance in the minds of first-time builders. I have seen several people chase this dream and fail or give up. While ambition is admirable, practical considerations should guide your initial steps. Building your “dream home” as your very first project can be a risky endeavor, often leading to unexpected costs, delays, and frustrations.

The First Build is always a Learning Curve

Construction, even on a modest scale, is a complex process. It involves navigating permits, sourcing materials, managing contractors, and understanding local building codes. Your first project will inevitably be a learning experience, filled with valuable lessons that you simply can’t learn from books or online resources.

Why risk your dream home on a process where mistakes are almost guaranteed?

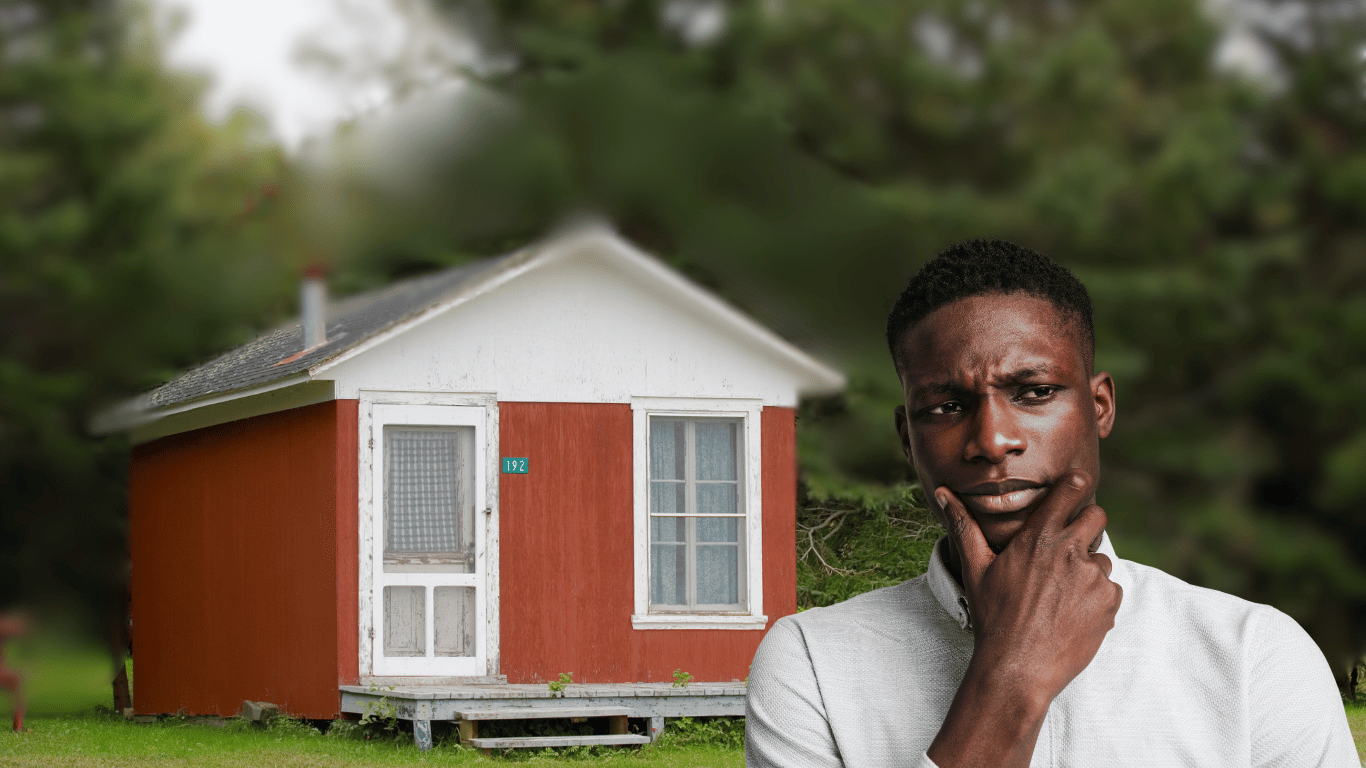

I believe building a smaller, simpler home is the best way to go. A long time ago (apologies to people born in the 60’s-70’s), government houses would have a main house and a servants quarters. These servants quarters would be 3 roomed houses (Not bedrooms) with a toilet/shower attached outside. No tiles, ceiling just basic finishes. Okay so maybe they were a bit too basic but here’s why you should start with a smaller project. Building a small first project allows you to do 4 things:

- Minimize Financial Risk: Construction costs can quickly spiral out of control, especially when unforeseen issues arise. Starting with a smaller and simpler project limits your financial exposure and allows you to gain experience without jeopardizing your entire savings.

- Gain Practical Knowledge: You’ll learn firsthand about budgeting, material selection, contractor management, and quality control. This experience will be invaluable when you’re ready to tackle your dream home.

- Avoid Costly Mistakes: Mistakes are inevitable during any construction project. By starting small, you can make those mistakes on a smaller scale, minimizing their impact on your finances and your overall satisfaction.

- Secure a Place to Call Home: Building a smaller, functional home provides you with a comfortable and secure place to live while you plan and save for your dream project.

The ideal first step is a simple, functional home.

Instead of jumping into a complex, expensive project like building your dream house or multiple flats, consider building a smaller, simpler home to start. A one or two bedroom (maximum) house with basic amenities can provide a comfortable living space while you gain experience and save for your dream home. Of course, this means when you buy a plot, buy as big as possible.

This approach offers several advantages:

- Lower construction costs.

- Faster construction time.

- Reduced stress and risk.

- Valuable learning experience. You will now practice what you learned on your main house.

- You get to monitor progress of your main house/dream house at close range since you will probably already live on the property and have acclimatized to living in the new area.

By starting small, you’ll be better prepared to build your dream home with confidence and avoid the pitfalls that often plague first-time builders. Your first home should be a stepping stone, not a financial and emotional burden. With careful planning and a realistic approach, you can turn your dream of homeownership into a reality, one step at a time.

What do you think about building yourself a small servants quarter first? post your comment below.